Tsakani Maluleke, auditor general

Photo: Facebook/Auditor-General South Africa

There is little to celebrate nationally and the Northern Cape is no exception, said Tsakani Maluleke, auditor-general (AG), in her latest briefing to the Portfolio Committee on Cooperative Governance and Traditional Affairs on the audit outcomes of municipalities for the 2022-’23 financial year.

Only three of the 31 Northern Cape municipalities had clean audits, six had an unqualified report with no findings, 17 had qualified reports, two had disclaimers, and three had outstanding statements.

The root causes for the poor performance are slow response from management and political leaders on oversight (68%), instability and vacancies (39%), some 7% had key officials who did not have appropriate competencies, and 68% had findings on consequence management.

She said little attention is paid to credible reporting on municipal performance, which is a key enabler of service delivery, transparency and accountability. She called on Dr Zamani Saul, premier, to influence the accountability ecosystem to improve how money is spent to improve service delivery.

‘Ineffective use of consultants’

“The culture will only shift once there is a change in the way officials are monitored and there are vigorous processes in place to hold staff accountable.”

In the latest report, some 11 municipalities (39%) have no findings on performance reports, while 25 municipalities (89%) had findings on compliance with legislation and her office issued 27 Material Irregularity (MI) notifications.

She says since they began implementing their expanded MI powers, “we have notified accounting officers of 27 material irregularities, 14 of which we raised in 2022-’23.

“Some of the high-impact areas in which we issued MI notifications are the ineffective use of consultants, the environmental impact of pollution, interest not being charged on overdue accounts, and payments relating to unauthorised debit orders.

“Non-compliance to supply chain management legislation is one of the main contributors to irregular expenditure. The closing balance of irregular expenditure remains high, at R3,43 billion, due to slow consequence management as action is not being taken against responsible officials.

Fruitless, wasteful expenditure escalating

“Municipalities incurred R417,58 million in fruitless and wasteful expenditure in 2022-’23, compared to R205,66 million last year, which puts even more pressure on the province’s available funding for service delivery. Coordinating institutions should enforce investigating unauthorised, irregular, fruitless and wasteful expenditure as well as applying consequence management.

“We previously highlighted the poor quality of performance reports, overreliance on consultants, poor management of resources under the control of local government, and material uncertainties relating to financial sustainability. But our messages were largely not heeded.”

Although the submission rate for financial statements improved, it is concerning that only 25 municipalities (81%) submitted their financial statements on time, and three audits are still outstanding because the financial statements were submitted late.

The Kai !Garib and the Kareeberg Local Municipality submitted their financial statements only after the AG notified the accounting officers of MIs relating to the non-submission.

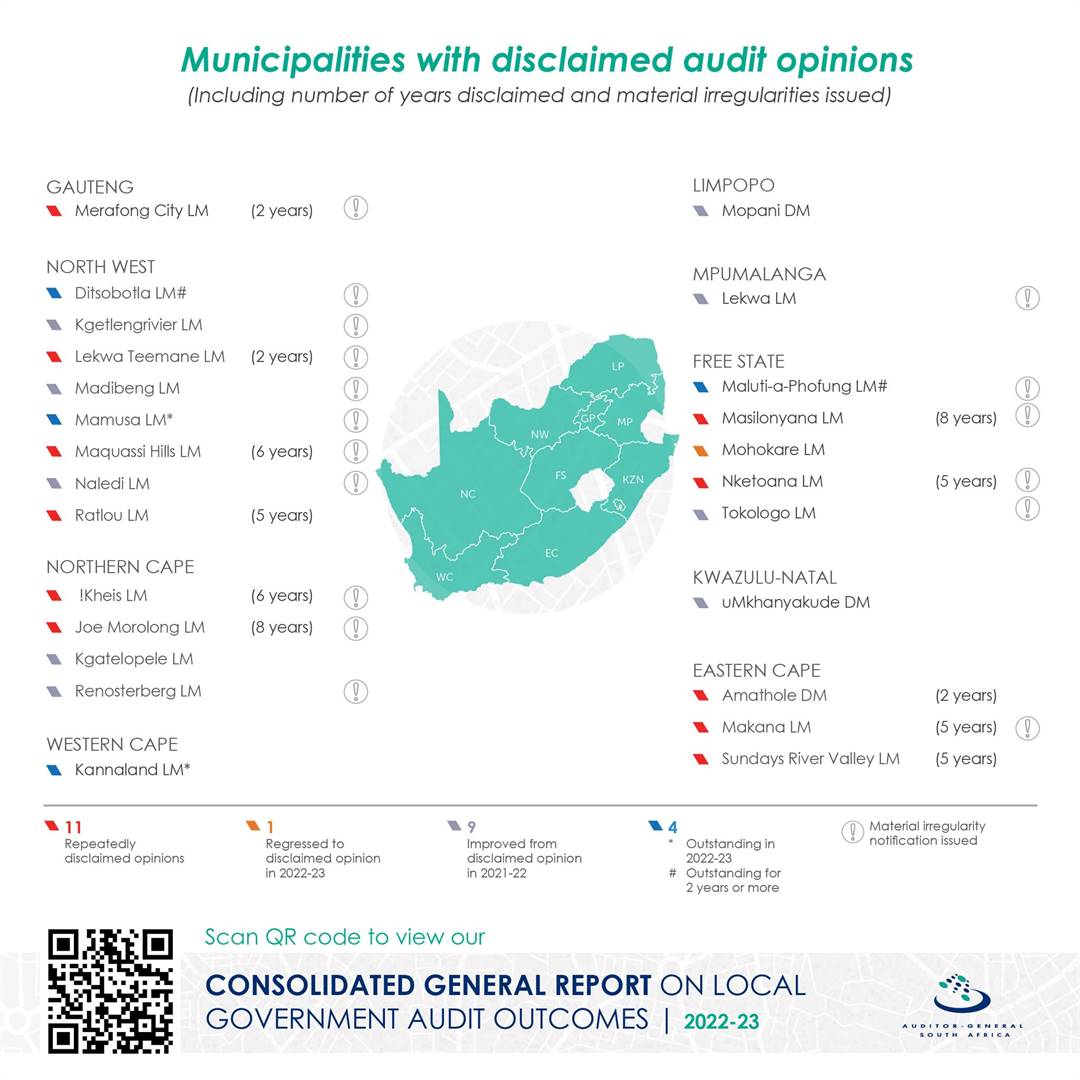

Her office acknowledged the Provincial Legislature’s efforts to reduce disclaimed opinions.

“We encourage it to expand its focus to include municipalities with both qualified opinions and unqualified opinions with findings. Improved record keeping should be central in this.”

The Kgatelopele and the Renosterberg Municipality that had previously received disclaimed audit opinions improved to qualified opinions in 2022-’23, while the Hantam Municipality regressed from a clean audit to an unqualified opinion with findings. This is due to non-compliance with legislation.

The improvement at Kgatelopele can be attributed to filling the municipal manager (MM), chief financial officer (CFO) and deputy CFO positions with skilled and experienced individuals.

Renosterberg continues to struggle to fill vacancies in senior management positions but was able to improve its outcome due to the good work done by staff members seconded to the municipality by the provincial government.

Richtersveld did not achieve any of its targets relating to maintaining existing bulk infrastructure and services.

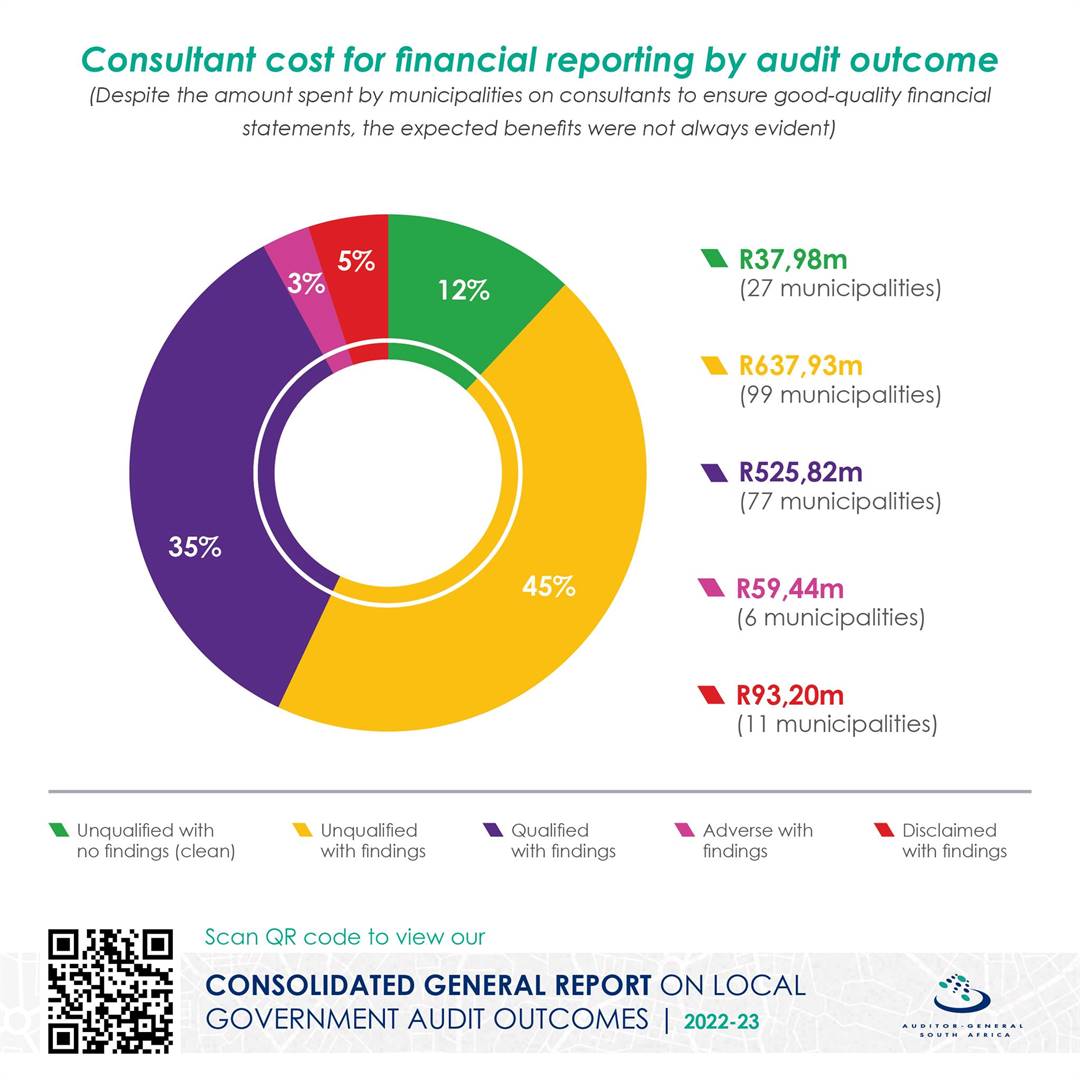

In 2022-’23, municipalities spent R432,73 million on salaries in the finance units, and an additional R127,05 million on financial reporting consultants at 25 municipalities. Despite this, only six municipalities (21%) were able to submit credible financial statements.

At 16 of the 25 municipalities that used consultants, the AG identified material misstatements in the consultants’ areas of work, “which not only brings the effectiveness of their work into question, but also confirms the need for competent individuals in the finance departments.

“Where the chief financial officer position was not vacant, those in the position had held it for an average of 73 months, which points to a lack of skills and competency in finance units rather than a lack of experience,” according to the AG.

Key points

- Three of the 31 Northern Cape municipalities had clean audits, six had unqualified reports with no findings, 17 had qualified reports, two had disclaimers and three had outstanding statements.

- Poor revenue management and poor debt collection stifle municipalities. More than half of the municipalities are financially distressed, with 17 municipalities reporting that they were not certain about their financial sustainability.

- Nearly three-quarters of municipalities (73%) will use more than half of next year’s budget to pay for spending done in previous years.

- Most municipalities depend on equitable share funds as 67% of municipal debt is not recoverable, mainly because proper credit control policies are not in place.

- Most municipalities did not carry out proper preventative repairs and maintenance on infrastructure and spent an average of only 1% of the value of that infrastructure on repairing and maintaining it, compared to the National Treasury’s suggested norm of 8%.

- Together with poor budgeting, with municipalities preparing unfunded budgets and using available cash to pay salaries, this leaves very little for service delivery, infrastructure maintenance and paying Eskom and the water boards on time.

- Four municipalities again did not submit their performance reports for auditing and another 13 municipalities could not publish credible reports.

- The lack of proper project management and monitoring has also led to ageing infrastructure not being adequately maintained in the province. Projects were significantly delayed by poor planning, vandalism, and a lack of contract management disciplines.

Charné Kemp

www.news24.com